Are you an OFW planing to return to the Philippines for good? If your anwer is YES, then read this article.

Returning to the Philippines after working overseas is a major life decision that requires thoughtful financial planning. Therefore, before you settle in Pinas for good, ask yourself: Do I have enough savings or investments to support my family long-term?

For example, if you have ₱500,000 in savings plus a small pension, you can better assess how this will cover your living expenses and business startup costs. Also consider if your family is ready emotionally and financially and whether there are jobs or business opportunities where you plan to live.

If you’re thinking of opening a small business, government programs can help. The National Reintegration Center for OFWs (NRCO) and Overseas Workers Welfare Administration (OWWA) offer livelihood grants, skills training, and business mentoring to returnees interested in entrepreneurship.

For instance, under the OWWA’s Enterprise Development program, many returnees successfully start small retail shops, travel services, or food businesses.

Thus, it is very crucial to make a clear business plan that includes market research and startup costs will increase your chances of success.

It’s also wise to protect your family and grow your savings through insurance. A Variable Universal Life (VUL) insurance plan combines life coverage with investment options, helping you build funds over 5 years or more.

For example, allocating a monthly VUL premium of ₱5,000 to ₱20,000 per month could grow into a sizeable investment while providing financial protection.

Check with trusted insurance companies and ask for plans with flexible contributions and riders for health coverage.

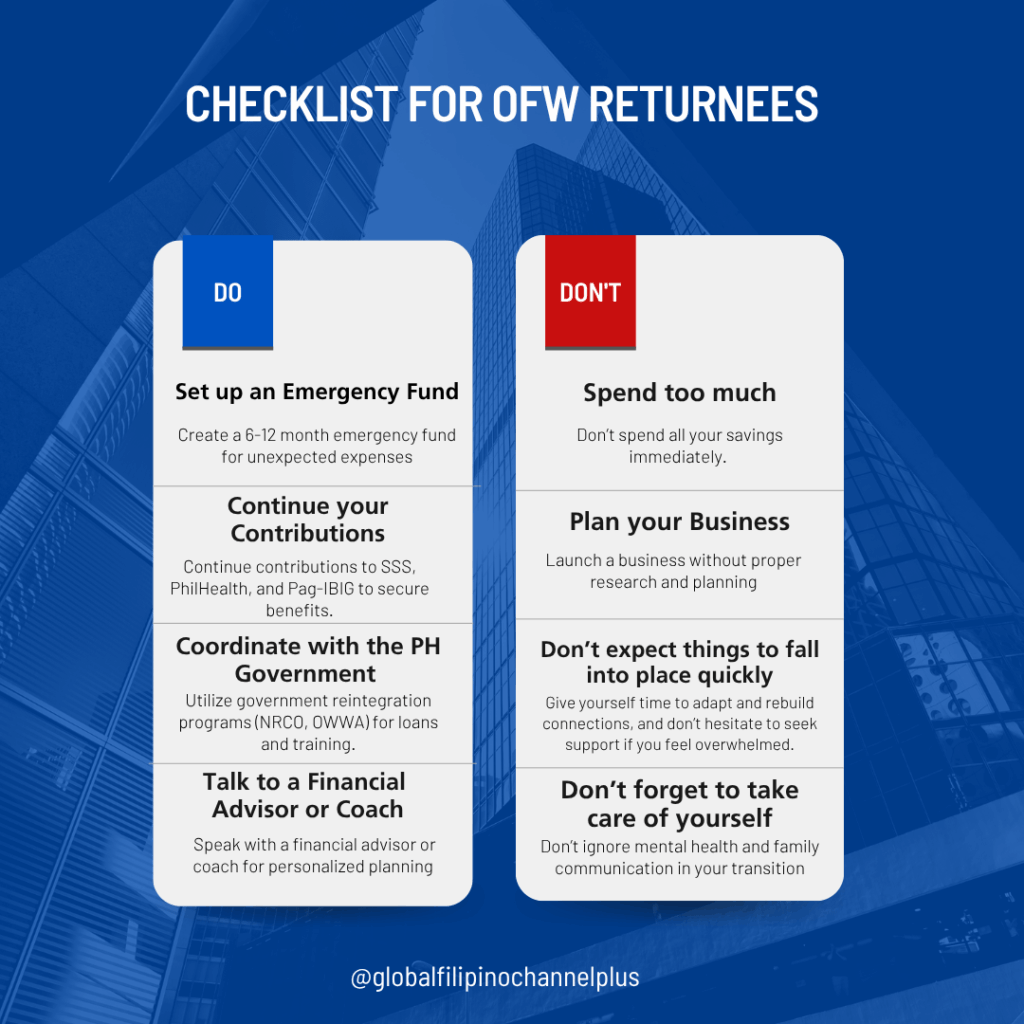

Checklist for Returnees

Set Up Your Expectations

Coming back home can be exciting but also challenging. It’s important to expect that the cost of living, lifestyle, school for your children or work environment may be different from abroad. For instance, a job in the Philippines may pay less, or starting a business may take longer to become profitable.

Don’t expect an instant lifestyle upgrade or that your overseas savings will last forever without a solid plan. Prepare mentally for adjusting to Philippine systems, reconnecting with family, and possibly slower career growth. Setting realistic expectations will help you avoid disappointment and stay motivated.

Good luck on planning your next move.